-

Posts

429 -

Joined

-

Days Won

27

Content Type

Profiles

Forums

Articles

Calendar

Blogs

Posts posted by Do Better

-

-

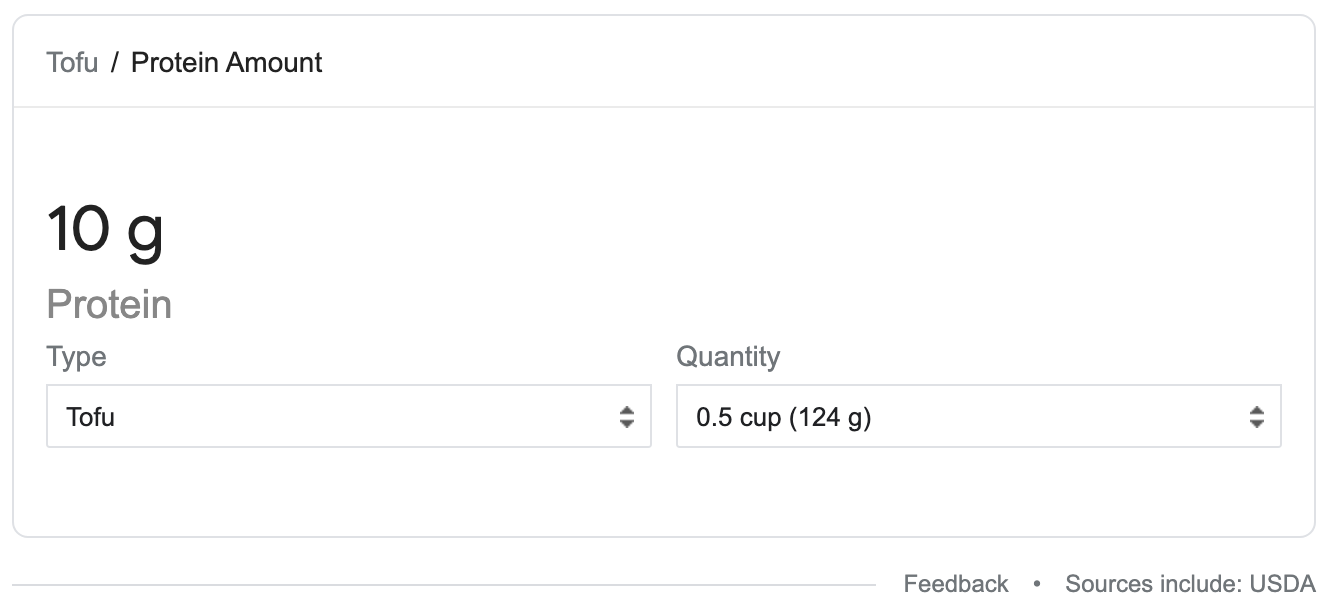

Tofu from Soybean curds has 10g protein per half cup serving (124g). Easy to cook and absorbs flavors well.

-

1

1

-

-

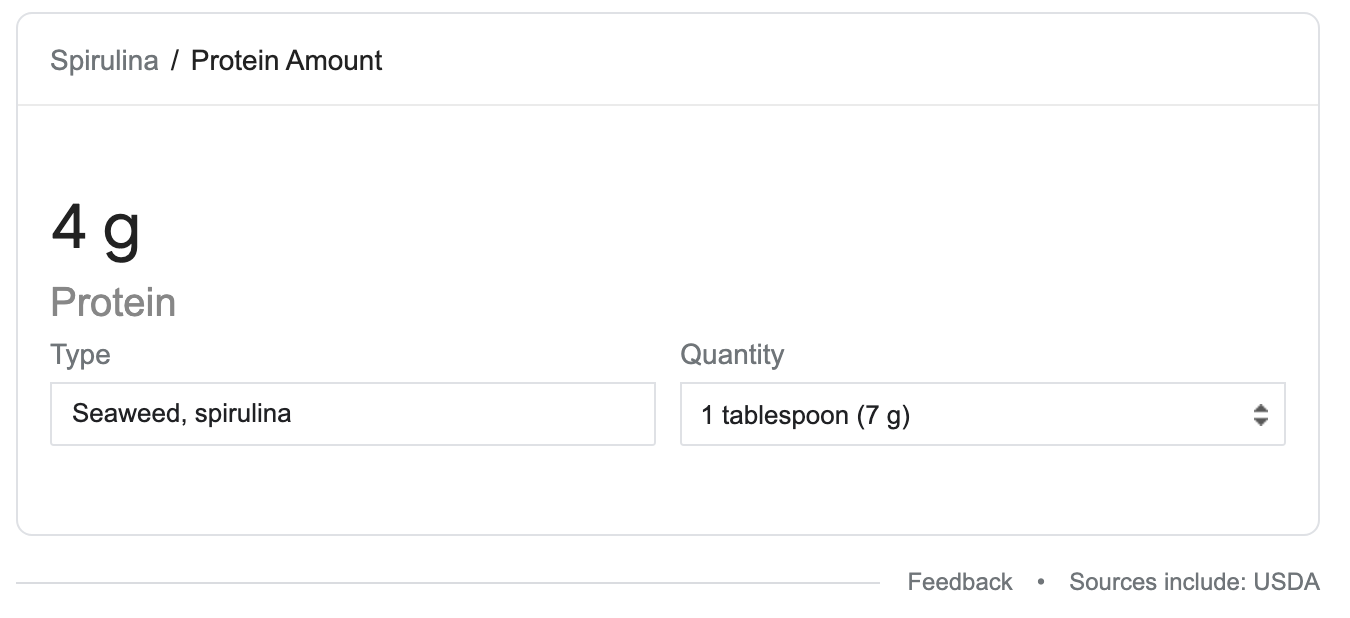

Spirulina - an edible blue-green algae that grows in alkaline lakes in sub-tropical areas. Historically gathered and dried directly from the lake by the ancient Aztecs. If it's got a touch of ancient in it, I'm in 🙂 It has 4g per 7g(tablespoon serving)

This protein source comes in powdered form, with dosage measured in tablespoons, not tablets. Don't buy the tablets if you want to benefit from the supplement. You mix a tablespoon of this into your coffee, kidding. This is mixed with green juice or shakes.

-

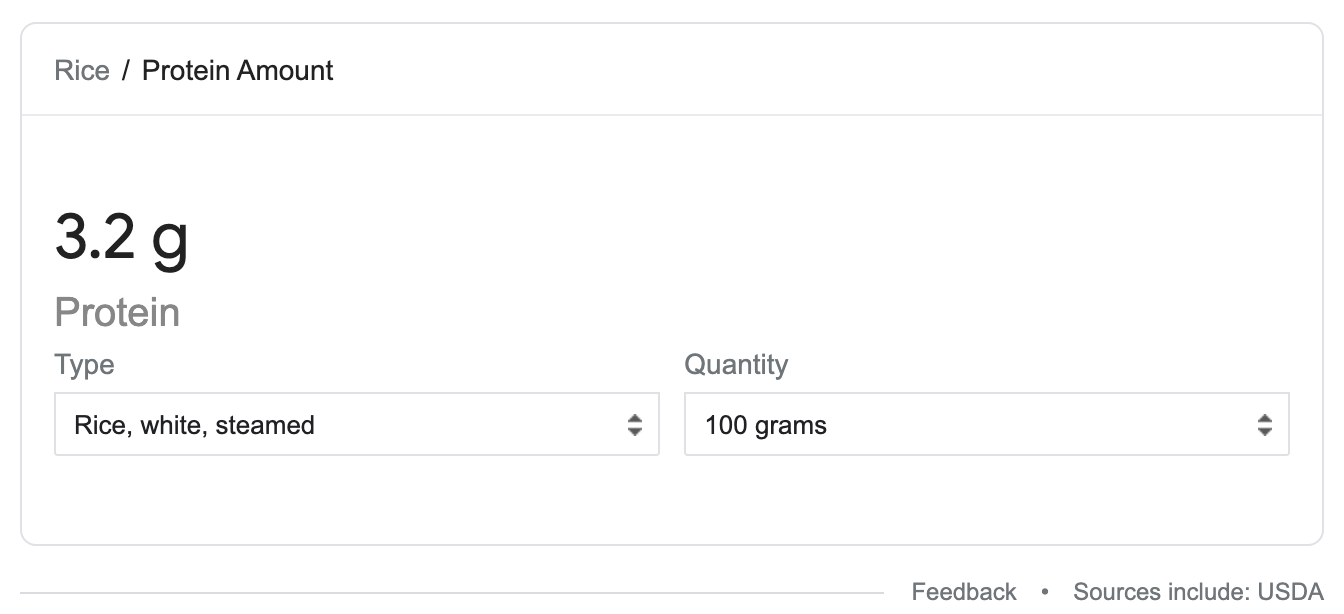

My second favorite source of vegetarian protein is Rice. 7g per 250g (1 cup serving) Asians love rice. This is a no brainer. Eat rice!

Now, if you really want to maximize your protein you can eat your rice raw! It will give you double the protein! Parboiled rice, do a search 🙂

-

Top Protein Food Sources For Vegetarians and Vegans

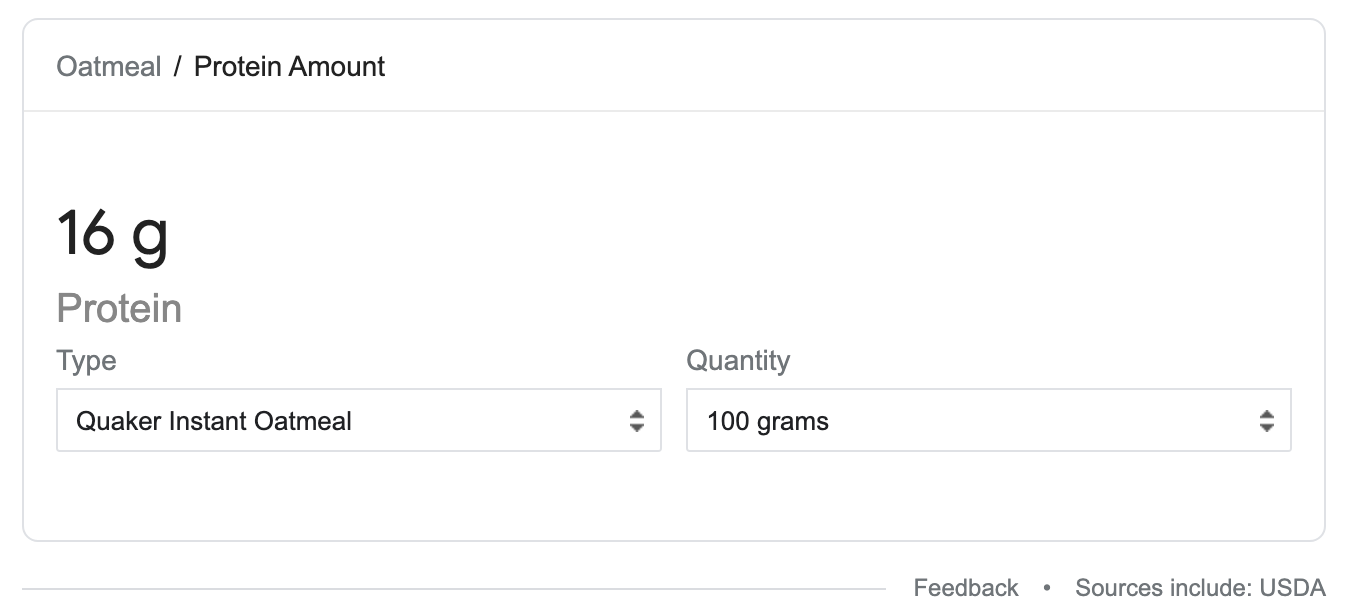

First on the list is Oats or Oatmeal. 16g of protein in Quaker Instant Oatmeal (100g serving)

-

Travelers

Headquarters: New York City, New York

Market share percentage: 1.96%

Average annual full coverage rate: $1,325

Average annual min coverage rate: $469

Travelers offers standard auto insurance coverages, as well as options to tailor your policy, like rental car coverage, new care replacement and accident forgiveness. The company’s savings and discounts might allow you to save up to 23% on your policy for bundling, safe driving or shopping early for a new policy.

Travelers received below-average claims service ratings from J.D. Power, as well as below-average customer service satisfactions scores in the specific regions in which it is available.

Standout feature:

Drivers in some states can take advantage of IntelliDrive, a smartphone app that tracks driving habits for 90 days and reduces the cost of your premium for safe driving, although you could also see a premium increase if your driving habits are not safe.

-

American Family

Headquarters: Madison, Wisconsin

Market share percentage: 2.07%

Average annual full coverage rate: $1,911

Average annual min coverage rate: $918

American Family, also widely referred to as AmFam, sells auto, home, life, health, travel and identity theft insurance, along with other insurance products. The company puts an emphasis on convenience, providing smartphone apps with features like easy bill paying and a Teen Safe Driver program.

Standout feature:

American Family’s Dreams Restored Program takes the stress out of finding a repair shop by connecting you with partner shops in your area. Bills are sent directly to the insurance company, so you never have to see them. The work also gets a lifetime workmanship guarantee from American Family.

-

Nationwide

Headquarters: Columbus, Ohio

Market share percentage: 2.32%

Average annual full coverage rate: $1,485

Average annual min coverage rate: $501

Nationwide offers both personal and business insurance services. Nationwide offers all the essentials in its policies, as well as optional coverages like towing, rental car coverage and gap coverage, which is designed to pay for the difference between your car’s value and what you owe on the lease or loan if your vehicle is totaled.

Nationwide’s J.D. Power scores also fluctuate by region, but the company did receive an above-industry-average rating for claims service.

Standout feature:

Through Nationwide, you can potentially earn $100 off your deductible for each year you practice safe driving, up to a maximum of $500. Depending on your policy, this could effectively cover your entire deductible.

-

Farmers Insurance Group

Headquarters: Los Angeles, California

Market share percentage: 3.98%

Average annual full coverage rate: $2,000

Average annual min coverage rate: $808

As the seventh-largest auto insurer in the U.S., Farmers offers robust insurance policies with a long list of unique features. For example, you can purchase ridesharing coverage if you drive for a company like Uber or Lyft. You may also be able to purchase OEM coverage, which will source original manufacturer parts for your vehicle if it is damaged. Farmers received an above-average ranking for claims satisfaction from J.D. Power.

Standout feature:

If you have recently purchased a new car, you may want to consider Farmers’ New Car Replacement Coverage. This optional coverage will replace your totaled car with a brand new model, as long as your vehicle is less than two years old and has fewer than 24,000 miles.

-

Liberty Mutual

Headquarters: Boston, Massachusetts

Market share percentage: 4.75%

You can purchase insurance for just about anything through Liberty Mutual, from home insurance to pet insurance. The company’s auto insurance policies are user friendly and easy to purchase and bundle with other policies. Bundling is not the only way to save. Liberty Mutual lists 17 different discounts on its website to help customers get the best price on their car insurance.

Like Allstate, Liberty Mutual does receive mostly below-industry-average scores from J.D. Power, so you may want to research customer satisfaction in your area if you get a quote from this company.

Standout feature:

Liberty Mutual’s Better Car Replacement program will replace your totaled vehicle with a model one year newer with up to 15,000 fewer miles than your old car.

-

USAA

Headquarters: San Antonio, Texas

Market share percentage: 6.32%

Average annual full coverage rate: $1,225

Average annual min coverage rate: $384

An insurance provider for military families, USAA offers heavily discounted auto insurance policies to service members with an average savings of $707 per year. USAA is the fifth seventh-largest auto insurance provider in the United States.

USAA consistently received high customer service scores with J.D. Power, although the company is not eligible for official ranking due to its eligibility restrictions.

Standout feature:

For military members who are deployed, USAA offers vehicle storage options and convenient payment schedules while you are away.

-

Allstate

Headquarters: Northbrook, Illinois

Market share percentage: 9.11%

Average annual full coverage rate: $1,921

Average annual min coverage rate: $696

Allstate makes it easy to bundle multiple types of insurance and save, offering auto, home, renters and life insurance coverages, making it a top contender on the list of car insurance companies.

Allstate’s customer satisfaction ratings from J.D. Power vary according to where in the U.S. you’re located at — Allstate ranks above average in some regions but below average in others. If you are considering a quote from Allstate, you may want to review your region’s specific reviews first.

Standout feature:

Allstate’s usage-based Drivewise program gives you up to a 10% discount for signing up. If you maintain good driving habits, you could earn up to a 25% discount on your premium. Drivewise participants can also earn rewards points, which they can redeem for car rentals, magazine subscriptions, gift cards and merchandise.

-

Progressive

Headquarters: Mayfield Village, Ohio

Market share percentage: 13.30%

Average annual full coverage rate: $1,509

Average annual min coverage rate: $582

Like others from the list of car insurance companies, Progressive offers more than auto coverage. You can insure your home, boats and RVs with Progressive as well.

Progressive’s customer satisfaction ratings from J.D. Power are mostly average. The company also received a below-average ranking from J.D. Power for claims service.

Standout feature:

Progressive’s Snapshot program personalizes your rate based on your driving record — safer drivers get lower rates.

-

Geico

Headquarters: Chevy Chase, Maryland

Market share percentage: 13.54%

Average annual full coverage rate: $1,405

Average annual min coverage rate: $433

Geico is one of the nation’s largest auto insurance companies and insures more than 28 million vehicles. The company is well-known for offering some of the lowest rates. Its slogan, “15 minutes could save you 15% or more on car insurance,” is especially memorable when paired with its commercials featuring the Geico Gecko.

Geico’s customer satisfaction ratings from J.D. Power are impressive — the insurer wins first place in customer satisfaction in the Northwest, North Central and Southwest. This may demonstrate that customers are generally satisfied with Geico’s customer service.

Standout feature:

Geico’s app makes it easy to view your policy, get quotes and file claims from wherever you are.

-

State Farm

Headquarters: Bloomington, Illinois

Market share percentage: 16.19%

Average annual full coverage rate: $1,457

Average annual min coverage rate: $539

State Farm is the largest insurer of personal autos in the United States. The insurer offers insurance, banking products and loans, which are all sold by State Farm agents. If you are in the market for insurance and banking services, State Farm is worth consideration.

State Farm’s overall customer satisfaction ratings from J.D. Power are mostly average. However, the company did earn an above-industry-average score for claims service. This indicates that customers are often satisfied with how State Farm handles claims in the event of a loss.

Standout feature:

State Farm has 19,000 independent contractor agents and 58,000 employees, making it easy to find help with your policy in your area.

-

1

1

-

-

What are the 10 biggest car insurance companies?

Although there are thousands of auto insurance companies operating in the United States, a handful of the largest companies dominate the market. The following list of auto insurance companies demonstrates how the top ten providers write about 73% of the nation’s auto insurance:

State Farm: 16.19%

Geico: 13.54%

Progressive: 13.30%

Allstate: 9.11%

USAA: 6.32%

Liberty Mutual: 4.75%

Farmers Insurance: 3.98%

Nationwide: 2.32%

American Family: 2.07%

Travelers: 1.96%

So how do these car insurance companies compare? Each has its own advantages and disadvantages, and the best company for one person may not be the best for another.

-

By contrast in January 2012 the United States Department of Justice seized and shut down the file hosting site Megaupload.com and commenced criminal cases against its owners and others. Their indictment concluded that Megaupload differed from other online file storage businesses, suggesting a number of design features of its operating model as being evidence showing a criminal intent and venture. Examples cited included reliance upon advertising revenue and other activities showing the business was funded by (and heavily promoted) downloads and not storage, defendants' communications helping users who sought infringing material, and defendants' communications discussing their own evasion and infringement issues. As of 2014 the case has not yet been heard.

In 2016 the file hosting site Putlocker has been noted by the Motion Picture Association of America for being a major piracy threat, and in 2012 Alfred Perry of Paramount Pictures listed Putlocker as one of the "top 5 rogue cyberlocker services", alongside Wupload, FileServe, Depositfiles, and MediaFire.

-

File hosting services may be used as a means to distribute or share files without consent of the copyright owner. In such cases one individual uploads a file to a file hosting service, which others can then download. Legal assessments can be very diverse.

For example, in the case of Swiss-German file hosting service RapidShare, in 2010 the US government's congressional international anti-piracy caucus declared the site a "notorious illegal site", claiming that the site was "overwhelmingly used for the global exchange of illegal movies, music and other copyrighted works". But in the legal case Atari Europe S.A.S.U. v. Rapidshare AG in Germany, the Düsseldorf higher regional court examined claims related to alleged infringing activity and reached the conclusion on appeal that "most people utilize RapidShare for legal use cases" and that to assume otherwise was equivalent to inviting "a general suspicion against shared hosting services and their users which is not justified". The court also observed that the site removes copyrighted material when asked, does not provide search facilities for illegal material, noted previous cases siding with RapidShare, and after analysis the court concluded that the plaintiff's proposals for more strictly preventing sharing of copyrighted material – submitted as examples of anti-piracy measures RapidShare might have adopted – were found to be "unreasonable or pointless".

-

In 2021 a European Citizens' Initiative "Freedom to Share" started collecting signatures in order to get the European Commission to discuss (and eventually make rules) on this subject, which is controversial.

-

On January 19, 2012, the United States Department of Justice shut down the popular domain of Megaupload (established 2005). The file sharing site has claimed to have over 50,000,000 people a day. Kim Dotcom (formerly Kim Schmitz) was arrested with three associates in New Zealand on January 20, 2012 and is awaiting extradition. The case involving the downfall of the world's largest and most popular file sharing site was not well received, with hacker group Anonymous bringing down several sites associated with the take-down. In the following days, other file sharing sites began to cease services; Filesonic blocked public downloads on January 22, with Fileserve following suit on January 23.

-

“The File Sharing Act was launched by Chairman Towns in 2009, this act prohibited the use of applications that allowed individuals to share federal information amongst one another. On the other hand, only specific file sharing application were made available to federal computers” (United States.Congress.House). In 2009, the Pirate Bay trial ended in a guilty verdict for the primary founders of the tracker. The decision was appealed, leading to a second guilty verdict in November 2010. In October 2010, Limewire was forced to shut down following a court order in Arista Records LLC v. Lime Group LLC but the gnutella network remains active through open source clients like FrostWire and gtk-gnutella. Furthermore, multi-protocol file sharing software such as MLDonkey and Shareaza adapted in order to support all the major file sharing protocols, so users no longer had to install and configure multiple file sharing programs.

-

From 2002 through 2003, a number of BitTorrent services were established, including Suprnova.org, isoHunt, TorrentSpy, and The Pirate Bay. In September 2003, the RIAA began filing lawsuits against users of P2P file sharing networks such as Kazaa. As a result of such lawsuits, many universities added file sharing regulations in their school administrative codes (though some students managed to circumvent them during after school hours). Also in 2003, the MPAA started to take action against BitTorrent sites, leading to the shutdown of Torrentse and Sharelive in July 2003. With the shutdown of eDonkey in 2005, eMule became the dominant client of the eDonkey network. In 2006, police raids took down the Razorback2 eDonkey server and temporarily took down The Pirate Bay.

-

Shortly after its loss in court, Napster was shut down to comply with a court order. This drove users to other P2P applications and file sharing continued its growth. The Audiogalaxy Satellite client grew in popularity, and the LimeWire client and BitTorrent protocol were released. Until its decline in 2004, Kazaa was the most popular file sharing program despite bundled malware and legal battles in the Netherlands, Australia, and the United States. In 2002, a Tokyo district court ruling shut down File Rogue, and the Recording Industry Association of America (RIAA) filed a lawsuit that effectively shut down Audiogalaxy.

-

In March 2001, Kazaa was released. Its FastTrack network was distributed, though unlike Gnutella, it assigned more traffic to 'supernodes' to increase routing efficiency. The network was proprietary and encrypted, and the Kazaa team made substantial efforts to keep other clients such as Morpheus off of the FastTrack network. In October 2001, the MPAA and the RIAA filed a lawsuit against the developers of Kazaa, Morpheus and Grokster that would lead to the US Supreme Court's MGM Studios, Inc. v. Grokster, Ltd. decision in 2005.

-

Gnutella, eDonkey2000, and Freenet were released in 2000, as MP3.com and Napster were facing litigation. Gnutella, released in March, was the first decentralized file-sharing network. In the Gnutella network, all connecting software was considered equal, and therefore the network had no central point of failure. In July, Freenet was released and became the first anonymity network. In September the eDonkey2000 client and server software was released.

Hi Protein Food For Vegetarians

in Health | Fitness | Diets | Well-being

Posted

I just listed 4 but there are more vegetarian protein sources. The list below contains my unfavorite sources or protein simply because you can't eat them in large amounts. Who eats a cup peanuts regularly?

Seitan, Tempeh, Edamame, Lentils, Beans, Chia, Yeast, etc.